First

Day trading is a focus-intensive, low-gain activity.

ESPECIALLY when starting out and having no trading experience whatsoever.

The risk of losing money is very real and uncircumventable.

Now, if you THINK you are an experienced trader who can make it work and always end up winning….

The amount of liquid capital you will be needing depends on a few factors:

- Your cost of living

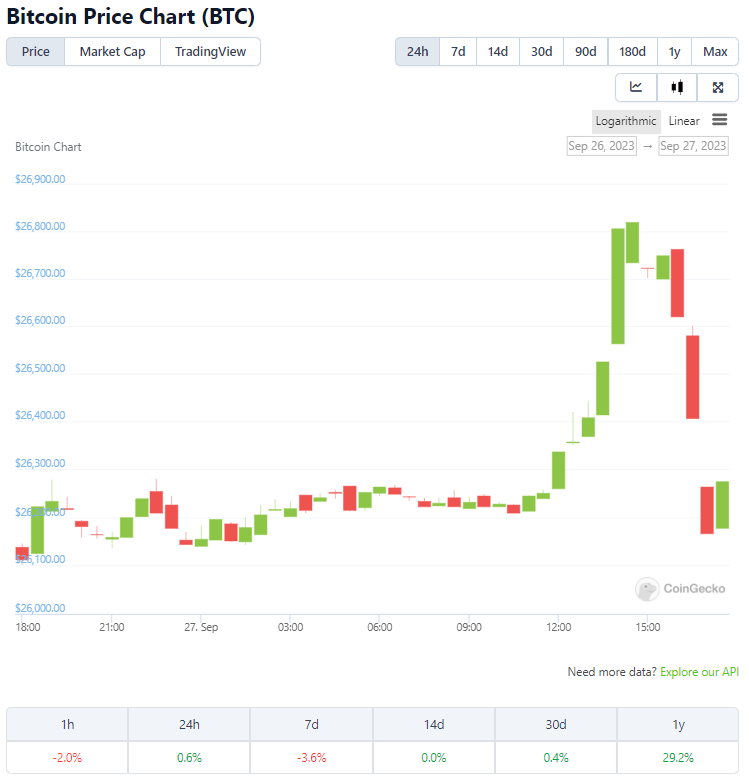

- What coin you want to trade with (we will do a simulation of day-trading in Bitcoin ($BTC).

Taking a look at the general increase and decrease of this coin, we work with increments ranging from a few tenths of a percent up to 2 or 3% or even more depending on market sentiment and volatility.

Market sentiment is key here as well as keeping an eye out for major economic events that can “flip” trends at random. During crab-markets (where most of the sentiment is going sideways) the general trading range trend is between 0.1% to 5%. When talking bear-markets and bull-markets can, on hourly and daily intervals, the percentages in range suddenly shoot up to 10 or even 20%. People will call these “god-candles” as they show true market sentiment.

Take note: I said “general increase or decrease” which implies you can have negative trades all day long (market value decreasing) or positive trades (market value increasing).

Example of the biggest god candle for $BTC to date.

If you are in luck and have winning streaks all around by correctly assessing the market trends within your hourly or daily time-frame than you will make profit. In all other cases will you need to add all your losses and wins together to get a correct overview on “how much” you made.

If we trade during a crab-market, trading range of 0.1% up to 5% of fluctuating value, you will need to average at an increase of 2% of your initial investment as profit.

This 2% must cover all your daily expenses (and preferably a bit more).

So how much do I need?

For a US-citizen it is estimated he/she spends about 165 USD a day.

That 2% profit made in day trading must cover the aforementioned amount (and a bit more).

To make it more easy on myself, I’d say you’ll need to get 200 $USD in profit by day-trading.

What is your liquid capital needed to achieve this?

2% = 200 dollar.

100% = 10.000 dollar.

10.000 dollar is your bare minimum IF you are a lucky and experienced trader.

That is 10.000 dollar you are willing to risk on each trade.

In most cases you will be needing a lot more than that (about double to be safe).

The reason thereof is:

- transaction fees

- Losses made due to bad trades

Naturally, if your daily budget for living surpasses the mentioned average will your needed liquid capital increase at the same rate.

To put the theory into practice and highlight a typical trading day.

This image shows the course of BTC over a 24h interval. As you can see, its value appreciated 0.6% over the course of a day but saw, temporarily, a tremendous increase and decrease on an hourly interval between 12:00 PM and 4:00 PM. Day trading implies foreseeing this “shake” and temporal anomalies. These are very difficult to predict and are a reason why you can make sudden tremendous losses or profits. Such movements are called “shake-outs” as they shake-out long and short trades while the net movement in trading range remains factually stable over the last 24 hours.

Advanced trading services (like TradingView.com ) allows for more details and adjustable ranges to monitor and help you get an idea as to what is going on. It provides a variety of frequently used, and highly theoretical, trading tools that could possibly help prospective traders to set up their trades. I am not going to get deeper into this for 2 reasons:

- It surpasses the answer to be given at the posited question

- My philosophy with Bitcoin is to HODL and use. Not to speculate as if a stock or an option due to trading being mostly akin to “educated gambling”.

The purpose of this platform, and the idea as to why I started GraciousInterests.com and became Crypto-educator, was to let people learn about Bitcoin, Cryptocurrency, Blockchain and all innovation sprouted from it. While trading is a hot topic, it is not something I actively cover nor will indulge in. If you want to learn about Crypto trading I will refer to renowned speculators in the sphere but will not give away signals or trading lessons.

Ending notes.

The purpose of this platform, and the idea as to why I started GraciousInterests.com and became Crypto-educator, was to let people learn about Bitcoin, Cryptocurrency, Blockchain and all innovation sprouted from it. While trading is a hot topic, it is not something I actively cover nor will indulge in. If you want to learn about Crypto trading I will refer to renowned speculators in the sphere but will not give away signals or trading lessons.

Does it mean I do not know how to trade? No.

I have a fundamental knowledge which allowed me to DCA (Dollar Cost Average) my bags since many years so that I am always in profit over a very long time frame. In my course titled “Crypto Bull” I lay down the basics on what to look out for and which coins/tokens can become worth your while. I give detailed pointers on what to look out for and the “when” and “how”. The book itself is more of a guide to learn DCA into Bitcoin and a variety of Crypto and not a technical trading guide (though some basics mentioned do share a common ground)

Leave a comment