Gold is a precious and rare metal.

It has unique qualities as a non-oxidization metal and very low reactivity with other metals.

But for what it is best-known for is its historical importance in Economies.

It has, still is and will remain to be, the most important metal when it concerns “wealth”.

ANY millionaire and billionaire has this asset in his/her portfolio in one way or another.

Be it through ETF, jewelry, incorporated in gadgets (watches, phones,…), cold solid bars of varying sizes..

Even on the Cryptomarkets you may find it has made its introduction in the form of asset-backed Cryptocurrencies. EKON GOLD , DGX and PAX GOLD to just name a few.

All three proving their worth by functioning as an effective buffer against inflation and being, when comparing charts with other coins, “true” to the definition of a stable-coin.

It shouldn’t come as a surprise I too have made investments, and regularly do so, in this precious metal. You may find the receipt here: “The Way Forward” .

Currently owning about 1000 EUR. worth of gold and increasing on monthly basis. Since I started saving and investing in gold, I have had a return of investment of about 160 EUR.

I invest about 100EUR a month to this asset.

My first investment was on 15th of October 2019.

The 100 EUR. I put aside each month is deduced from “gaming money” I would otherwise use for online subscriptions (like World of Warcraft and Runescape).

Money I would spent on in-game goodies and monthly payments.

Now, those who know me in person KNOW I do not spent that much money on gaming to begin with.

The biggest part of the 100EUR. I put on the side is from living a healthier lifestyle.

I rarely drink sugary drinks (none in my house), generally drink tapwater (I have the advantage of living in a country with clean water) and always cook home-made meals.

I rarely eat-out to fast food joints or restaurants as the things I cook are to a higher standard than the things you eat in an average restaurant.

The lesson here is that I managed to redirect my resources and invested into an asset and not in liability (games and fancy dinners – trash food).

It should be noted that the screenshots are from an online platform.

I am subscribed to a platform where I can buy gold and have it stored into a vault of my choosing.

The platform is called “Goldrepublic“.

This is a Dutch company who sells and stores Gold, Silver and Platinum.

Storage can be chosen between Amsterdam, Zurich or Frankfurt (I highly advise opting for storage in Zurich… through experience I noticed gold prices fluctuated less when the gold is stored in Zurich due to involvement of the Swiss Franc which is a very stable currency).

Those who are more familiar with Cryptocurrency-trading may opt to go for Bitpanda Metals.

I cannot give too much advice on the latter as I do not use the Bitpanda-platform. The reason why I choose GoldRepublic has to do with proximity (an easy 3hour ride) and it being a native Dutch company (my mother tongue) so there is the impossibility of ambiguous translations or communication.

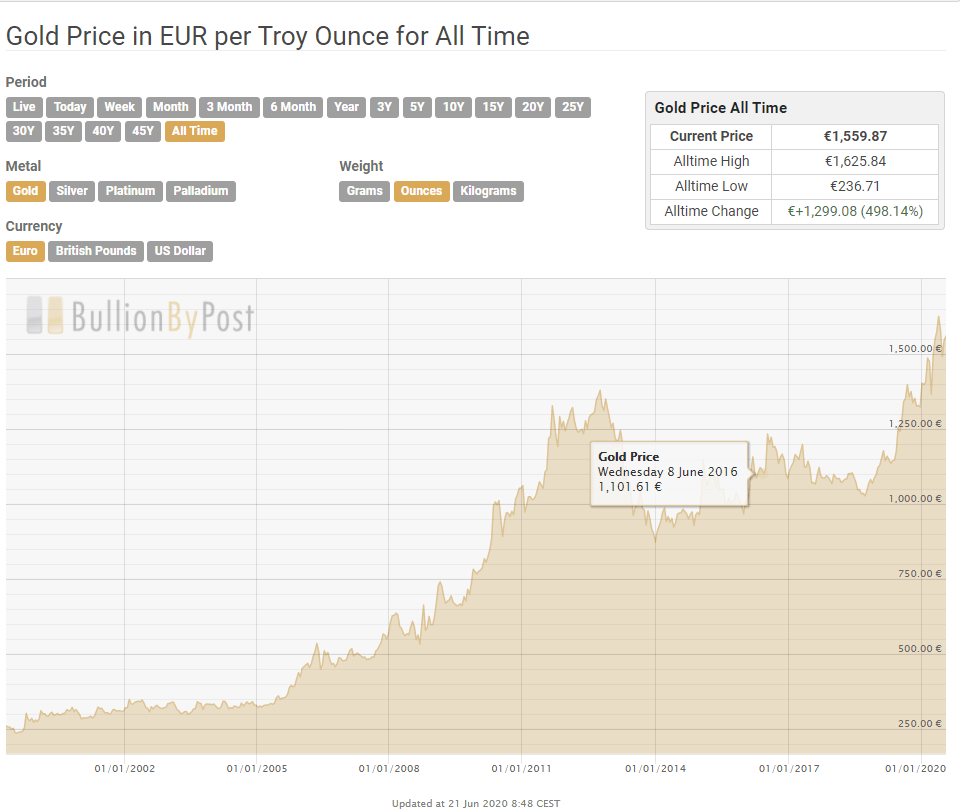

The reason to invest in gold can best be illustrated with a historical graph of its price:

The graph shows a clear upward trend.

Despite the gold-price crash of 2014, the price itseld corrected itself within 2 years time.

If we take the median trend, price is increasing in a steady up-ward motion (almost exponentially so).

Gold is an asset to hold long term.

Do not expect to make quick gains on short-term (unless you are a professional FOREX-trader). For the average Joe like myself and yourself it is an investment for long term.

An asset sharpened when keeping an eye on rare occasions whereby the price suddenly drops due to politics and local deflation of the currency.

It won’t be too long before a good sizeable amount can be gathered.

At this moment I am 30 years old.

If I keep up the 100 EUR. investment a month for the following 30 years, I may AT LEAST have made 100K in pure ROI and even more in total.

This, when projecting it linearly.

In reality it will be higher as depending on the economy and “opportunities” the investments may increase.

This is my single-most greatest asset to have.

And I advice ANYONE who is half serious about their finances to get their hands onto gold as soon as possible.

Leave a reply to To rise above. – DH CONSULT-COMFORT Cancel reply