To understand #BTC and all of its fundamental movements is to understand:

- How people behave (organic aspect)

- How markets work (which influences the first)

- What scarcity is (and the “shocks” related to it).

- What cycles are.

The first three points can be deduced by keeping pulse on latest news of the economy.

Economy goes bad, everything goes bad.

BTC now has many derivatives, futures and ETFs for trading.

A lot of speculation is now being done by no-coiners.

They can leverage the market.

So it IS important what the global economy is doing.

Printing dollars has an effect on #BTC value.

Trade wars have an effect on #BTC .

Tensions and war have an effect on #BTC .

Mainstream adoption have an effect on #BTC .

Pandemic (fake or real) has an effect on #Bitcoin .

But the most interesting part to know which way #Bitcoin is going?

Taking a look at its history and cycles.

Bitcoin (and the entire #Crypto market) works in cycles.

These cycles are initiated by events concerning supply on the most important and dominant coin(s) in #Crypto markets.

The most MAJOR ones being #Bitcoin halvings.

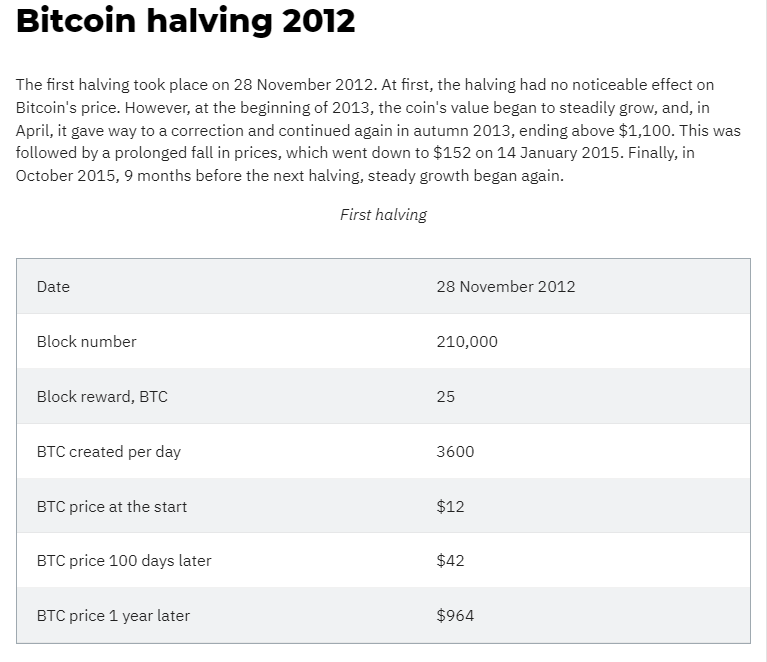

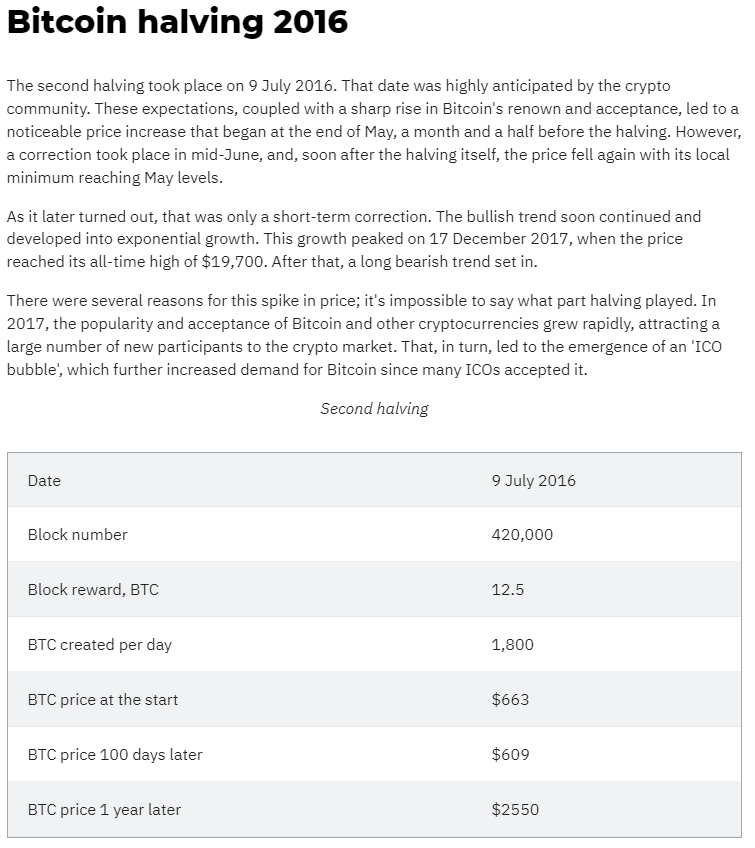

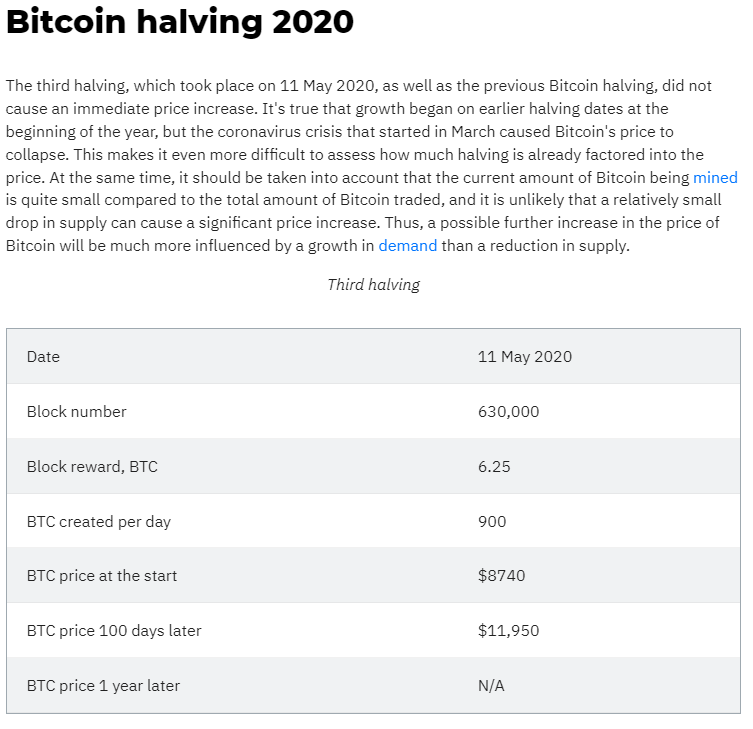

Observational trends from previous halving events indicate how the macro market will play out. Following pictures describe the observations made during previous halvings.

What do we notice?

– Price increase before the halving

– Correction AFTER the halving

– Price after a while INCREASES to new ATH

– A long bearish (side-ways trading) period comes in.

What does this tell us about #BTC and #Crypto market from this day on?

Chances of #BTC reaching 100K $USD this year are slim….

UNLESS MAJOR DEMAND is inbound.

But it is programmed for the next cycle in 2025.

All of these insights can be achieved by knowing your fundamentals.

To observe and see how Bitcoin and the entirety of the Crypto market works!

This is the main reason why I established my dedicated course “The Ultimate guide To Cryptocurrency”. Get it here:

Ultimate Guide to Cryptocurrency

Leave a comment