Let’s talk a bit about supply shocks and trading volumes.

As many of you know does #BTC , and all other #cryptocurrencies , at base level function on the simple economic premise of “Supply and Demand”.

This makes halving-events so important.

A halving-event is about the rewards from mining being slashed in half.

Meaning that after such an event only HALF of newly created coins will enter the market.

Many PoW-based coins (such as #Ravencoin ) have these halving events.

It enabled a supply-shock to take place.

#BTC is the most dominant coin.

It is at the front of the market.

Whatever it does, the entire market will follow.

In 2020 did its 4th halving take place.

Through previous cycles do we know how markets will behave.

A run-down can be found here:

An important metric when trading is not only knowing where we are in the #BTC cycle, but also knowing what kind of other events and metrics can influence value.

Wars, pandemics,…

Due to the creation of ETFs in 2020-2021 has #Crypto become very tied with classic finance.

Supply and Demand.

With ETFs do you not have actual ownership of the #cryptocurrency you are trading. You are merely speculating (🚩) with the ownership of said #Crypto by the third party platform.

You do not own the #BTC .

The platform does.

The platform (exchanges and trading platforms alike) will act like a speculative whale.

This is quite an unhealthy position as it can leverage the market.

Hence why I, and many other more experienced Crypthusiasts, advice to “buy the real deal and withdraw into private custody”.

This means an outstream of #Crypto and #BTC from exchanges.

Decreased supply and even (or higher) demand will result in the asset becoming more valuable.

Hence why #BTC rallies when the market settles and tries to find a new equilibrium with the reduced supply.

The effects of a halving event.

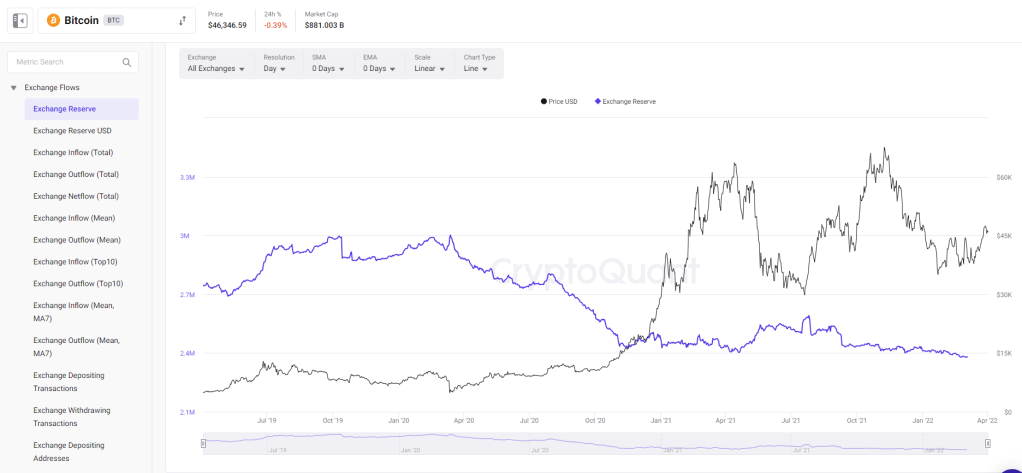

Halving of #BTC took place in May 2020. Supply corrected until October 2020 which initiated the Bull-run.

You can see this very clearly on the graph below.

Some might say that a supply shock COULD initiate a new run.

Talking from experience, this might always happen.

But is not all too likely.

As can be seen in the graph, the market has stabilized.

Other metrics are in play now.

A competition of demand for current supply.

Leave a comment