In this entry we divulge into token standards.

When entering into Crypto it is quickly realized that not all Cryptocurrencies have their own native chain and are “built upon others”.

This means that on certain blockchains it is possible to start building applications and other Cryptocurrencies. It allows people to built upon an existing network which provides a plethora of advantages when compared to creating a network from scratch:

- Existing infrastructure for easy integrations

- Partial inherited security

- Easier on-boarding of people

- Scalability

- …

With the rise in popularity of memecoins (such as PEPE , Shiba Inu, Dogecoin,…) will you see that most of them (exceptions exist) will be built upon an existing chain.

The greater majority of them being built on Ethereum, Binance, Tron,.. and recently ,with the introduction of the BRC20-standard, on Bitcoin as well.

But what exactly are these BRC20, ERC20 etc.. standards?

This is what we are going to explore. Before getting deeper into the various standards which exist it will be helpful KNOWING what a token standard is.

What are token standards?

Another word for Token Standards is “Token Contracts”.

What are Token Contracts?

A Token Contract is a special type of Smart Contract, which maps blockchain addresses to balances of value units – aka tokens. These software programs hold code, which specifies a set of functions and attributes of the value units, created and managed by the contract.

Or in more plain terms:

They are digital algorithms (simple programming rules) which will monitor and map blockchain addresses and the amounts of tokens they hold. They specify a set of functions and rules by which the addresses must abide and whom are managed by the contract.

The token contracts allow for the creation of additional “assets” upon the existing blockchain and to interact and work with a fixed set of rules.

As we are talking about programming, this means that the rules and interactions that are allowed can vary depending on the desired outcome. As a result do various standards exist which allow for a variety of functions that developers can make use of for their idea/project.

Many token contracts / Token Standards tend to be based upon a previous standard. They evolved due to demand for additional functions that the original standard could not support.

The most renowned blockchain which started introducing these standards is Ethereum.

So let us begin with giving an overview of the current Token Contracts and their capabilities.

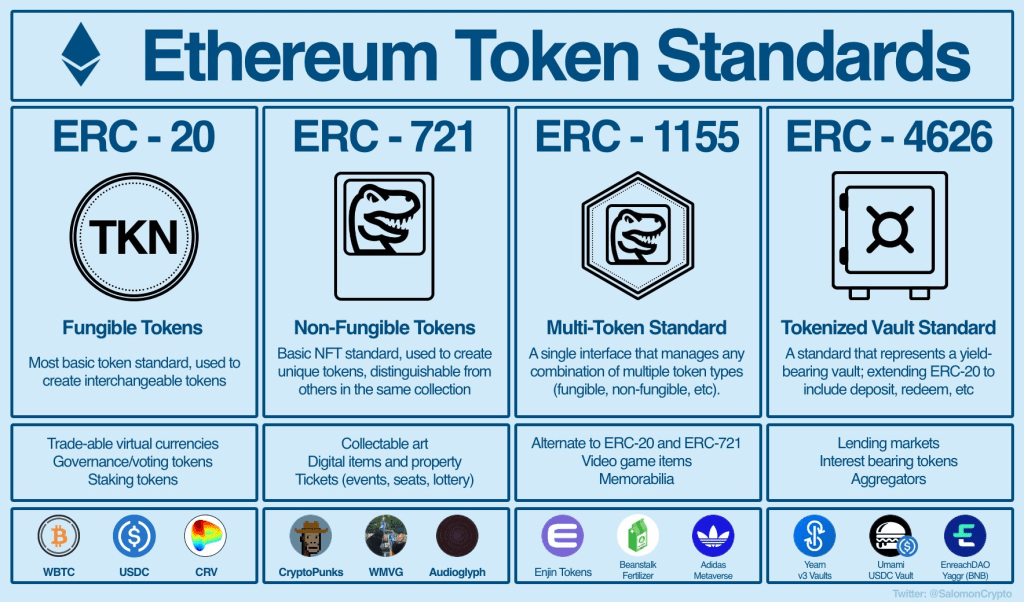

The ERC20 standard.

The ERC20 (Or its full name: Ethereum Request for Comment 20) standard allows for the creation of fungible tokens on the Ethereum blockchain. “Fungible token” just means that the token created can be exchanged with another same token. It is best to visualize “fungibility” as such:

1 $BTC = 1 $BTC

1 $ETH = 1 $ETH

1 $PEPE = 1 $PEPE

And so forth.

It implies that each token created with this standard is equal to any other created by the developer. The tokens created with the ERC20 standard are useful for things such as:

- Medium of exchange (like traditional Cryptocurrency and fiat money)

- Voting rights (within the built ecosystem)

- Governance (tied with voting rights)

To get a full-on view to the capabilities of ERC20 tokens it suffices to look-up to all tokens created using ERC20. An overview can be found here.

The ERC677 standard

The ERC677 standard is an extension on the ERC20 standard and an improvement which fixes the exploits of the ERC223 standard.

ERC223 standard was created to simplify transactions between contracts that did not support the ERC20 standard. ERC223 was an intermediary fix but opened up a whole plethora of problems.

Thus the ERC677 standard was introduced as a “perfect” version which allows for better communication between various token-contracts.

ERC677 should thus be seen as THE standard for the creation of Smart Contracts.

It allows for:

- Information transfer

- Call the token contract with additional data in order to trigger a function.

Not a whole lot of tokens make use of this standard.

The most renowned project which is an ERC677 token is CHAINLINK.

The use-case of CHAINLINK perfectly describes the function of the ERC677 token standard.

The ERC721 standard.

ERC20 is about creating fungible tokens onto the Ethereum Blockchain.

ERC721 is all about creating Non-Fungible Tokens (NFTs) on the Ethereum Blockchain.

If you do not know what NFTs are, this useful guide will give you the basics to it all.

The ERC721 standard is more complex in built than the ERC20 standard. It has all of the previous aspects of the ERC20 standard but is more complex due to the non-fungible nature it entails.

ERC721 standard is the basis to most NFTs present on the Ethereum blockchain.

This standard is being used for asset-tokenization. Connecting real-world assets with the security of blockchain technology and the uncompromising Proof-Of-Ownership it entails.

ERC721 standard is therefor mostly used to create:

- Tokenized Real-estate ownership

- Collectibles

- Gaming (GameFi)

As well as

- Voting rights

- Governance

- Medium of exchange

A full list of existing ERC721 tokens can be found here.

Exploring this list can give some valuable insights into the extends that ERC721 can be implemented as well what is possible with this standard.

The ERC777 Standard

The ERC777 standard has more in common with the ERC20 standard.

This token contract allows for more automated functions than the ERC20.

This means that ERC777:

- Is about creating fungible tokens (like ERC20)

- Has all of ERC20 functionalities.

Where’s the difference?

The ERC777 Standard has broader possibilities where it concerns trading and token interactions.

The most easy and straight-forward way to distinguish ERC777 from ERC20 is that ERC777 allows for DEx (Decentralized Exchanges) to be created on the Ethereum blockchain.

ERC777 has a much more intimate relationship with $ETH as it introduces the concept of “hooks” which allow for more information and capabilities to be communicated and shared. It also helps to reduce the likelihood of tokens remaining stuck in a contract (which is common under ERC20 standard).

In plain English: A hook is simply a function in a contract that is called when tokens are sent to it, meaning accounts and contracts can react to receiving tokens.

The ERC777 standard also allows for automated trading, minting and burning (which are functions often used in DeFi settings). It also allows for extra functionality to the tokens such as:

- Mixer contract (to further secure and increase confidentiality)

- Emergency recovery (functions) when private keys are possibly lost

- The “hooks” streamline the process how contracts and accounts communicate when receiving coins

Additional: the ERC777 standard is backwards compatible with ERC20.

The ERC1155 Standard

The ERC777 is to be seen as an extension and more developed version of the ERC20 standard.

The same applies to the ERC1155 Standard when compared to the ERC721 standard (as a BIG generalization).

The ERC1155 standard takes all of the best aspects of the previous standards and improves upon them. It is a token standard that aims to take the best from previous standards to create a fungibility-agnostic (i.e. you can create fungible and Non-Fungible tokens) and gas-efficient token contract.

The most distinctive feature of the ERC1155 Standard is that, when compared to the other standards, it only uses 1 smart contract to define and create all functions. This makes the ERC1155 standard best called as the “Multi-token standard” as it has been developed to handle various tokens within the same project.

As the ERC1155 Standard only makes use of a single smart contract, and does not need various smart contracts to function, will it give rise to gas-fee efficient projects where multiple tokens are needed.

The ERC1155 Standard is best used in projects that are related GameFi or Blockchain-based gaming due to the nature of this standard (ability to create multiple fungible and non-fungible tokens in one smart contract).

This does not mean that no blockchain-based games were created before this standard was introduced. All that this standard does is to allow for more (gas-)efficient applications to be built that do not rely on multiple smart contracts to function.

The ERC4626 Standard

Whereas all previous standards added and improved upon the functionality of “creating” on the main blockchain is the ERC4626 standard the odd-one out.

It introduces the functionality of “vaults”.

What are Vaults?

Vaults are smart contracts that take in token deposits and do something with those tokens to provide token rewards to the depositor.

In other words:

A standardized function that provides yield.

Within DeFi are lending and borrowing services being used.

A plethora of Ethereum-based projects, during the 2021 Bull-run, have been promising “yield” when you were to deposit your coins with them.

During that same bull-run have countless projects promising high yield been exposed to compromise due to flaws in the programming. Other projects promising high yield were built with the idea that a continuous inflow of fiat money to the network would be established. These failed to account for the cyclical nature of the Cryptocurrency market and the subsequent bear-market that would follow.

As a result of the many hacks which occurred during the 2022 bull-run with DEx projects came the need for a new and secure standard which would lessen the likelihood of compromise.

A standardized procedure to create yield-bearing projects. This standardization makes integration and composability more easy as each protocol no longer needs to implement and create its own adapter (which would have lead to more errors, attack vectors and wasted development resources.)

In plain English terms:

The ERC4626 Standard introduces the TradFi concept of “yield” (or interest) which allows for a plethora of TradFi services to be made available onto blockchain.

This also means that some inherent flaws to TradFi, with this standard, are still present.

The major flaw of inflation (due to yield) which will result in loss of value over time.

Leave a reply to Developers guide to Token Standards: BINANCE – Gracious Interests Cancel reply